Deadline: October 4, 2017...

Read This Or Miss The

Next Bakken

A tiny oil company has won the right to tap into

$490 billion worth of proven oil reserves in Mexico

This development is giving investors just like you a brief

opportunity to make 600% on your money by year’s end

(And millions of dollars in the coming years)

The date was February 10, 1916.

The place: an oil well deep in the jungles of Veracruz, Mexico. Drilling had commenced several days earlier and had reached a depth of 1,752 feet.

Then it happened.

A blast of crude exploded up from the well, destroying the derrick and ejecting drilling tools up to 120 feet away.

For nine straight days, the gusher shot higher and higher, finally reaching an estimated 598 feet and raining oil as far as two miles away.

On February 19, the day the well was finally capped, it blew an incredible 260,858 barrels in 24 hours.

This was the famous Cerro Azul No. 4 well, which was in the Golden Lane Trend of the Tampico-Misantla basin. Since that historic gusher, this basin has produced over 5 billion barrels of oil.

Most of it was extracted by the late 1930s. Since then, flows have reduced to a trickle, and the basin has become a low priority for Mexico’s state-run oil company, Pemex.

The company figured most of the oil was gone, so it moved on to other projects.

But They Were Wrong About Tampico-Misantla

In fact, there’s at least another 5 billion barrels of oil waiting to be tapped there, according to IHS Markit.

And all that oil is about to do for Mexico what the Bakken did for the U.S.

One micro-cap company is playing a key role in recovering that oil, as it won a bid on a prime block of Tampico-Misantla property last year.

Since then, its stock has risen 171%.

But I’m convinced that’s just the beginning.

As of this writing, you can get this stock for under a dollar.

Quite a bit under, actually.

In fact, as I write to you now, it’s selling for $0.32 a share.

A penny stock, yes...

But this is no ordinary penny stock. In fact, it has the potential to make you a millionaire.

That’s because in a few years — and I know this sounds hard to believe — this small-cap energy company could become a serious mid-tier producer worth $10 or more a share.

Think About it... From $0.32 to $10

Is a Gain of 3,025%

A gain like that would turn a $10,000 investment into $302,500.

Sure, winners that big aren’t common.

But with junior energy companies, they happen more often than you’d think.

Like when Kodiak Oil and Gas skyrocketed from $0.42 to $15.99 over six years, a 3,707% moon-shot...

That would have turned $10,000 into $370,700.

Abraxas Petroleum shot up 1,368% — from $0.56 to $7.93 — in about three years...

Transforming $10K into $136,800.

Whiting Petroleum rewarded investors with gains of 1,015% over 11 years, exploding from $8.31 to $92.66.

A $10,000 play there would have turned into $101,500.

And how about Magellan Petroleum? That stock soared 2,581%, from $0.53 to $14.21 in about a year and a half.

$10,000 on that stock would have given you a $258,100 windfall.

Now the Table Is Set for Gains Like These in Mexican Oil

The micro-cap oil company I told you about could easily outperform any of those companies — and quickly.

In the short term, I fully expect it to give you 600% gains by year’s end.

And much, much more after that.

I’ll tell you more about this rare windfall opportunity in a moment, but first let me explain...

Why You Should Listen to Me

I’m known as “The Hammer,” although my given name is Christian DeHaemer.

I’m a U.S. military-trained fortune seeker with a vast network of worldwide contacts in business and intelligence circles.

Those contacts — and my willingness to journey to far-flung, dangerous places all over the world to investigate their tips — help me find small, little-known energy companies with tremendous upside.

Like Petro Matad, a tiny company that made a huge oil find in Mongolia.

The result? A 759% windfall.

And Africa Oil, which made multiple oil discoveries in Kenya, resulting in a 411% gain.

And Cove Energy, which made multiple oil finds in Africa, including Tanzania, Mozambique, and Kenya...

A play that paid off with a 117% gain in just under four months.

As a result of those discoveries, Cove grew from a penny stock to a $1.5 billion company.

Now I See the Best Oil Play of My Life

It’s all about that $0.32-per-share junior oil producer. This tiny company is opening up an opportunity for you to get in what I call the “next Bakken.”

I call it the “next Bakken” because the oil situation in Mexico is very similar to the oil situation in the U.S. in 2006 — right before the Bakken took off.

Thanks to fracking and horizontal drilling technologies that unleashed shale oil there — not to mention in the Eagle Ford, the Permian basin, and other previously landlocked deposits — the U.S. went from importing 60% of the oil it needed in 2006 to 24% in 2015.

And by 2019, it’s estimated that the U.S. will be completely self-sufficient in oil thanks to these new oil extraction technologies.

Now it’s Mexico’s turn.

And it’s about to unlock the country’s shale oil and create fortunes for early investors in this tiny oil company.

It reminds me of a similar opportunity some years back...

The Comstock Story

Comstock Resources is an onshore oil producer that began operations in 1990. For its first 10 years, the stock never closed above $5 (it once hit a low of $1.06).

Finally, management realized they needed a partner to expand operations.

So they collaborated with a new company to allow it to drill for oil in Comstock’s offshore properties in the Gulf of Mexico.

To say it was a successful move would be an understatement — in Q3 of 2007, it netted $16.4 million... in Q4 of 2008, $224.6 million.

The result: the stock skyrocketed to over $422.15 a share.

That’s a gain of 39,725%!

Can you imagine what a windfall like that would do for your portfolio? For your retirement account?

A mere $200 investment would’ve turned into $79,450.

$1,000 would have become $397,250.

How about $10,000? That’d be a cool $3,972,500.

Think that kind of money would change your life? What would you even do with it all?

That’s the kind of home run every investor dreams of.

Well, guess what? A very similar situation is happening right now in Mexico... and the chances to secure the kind of riches I’ve been telling you about are very real.

We have the Mexican government to thank for that...

How Mexico Is Giving You the Chance at Obscene Profits

Remember the Cerro Azul No. 4 well that blew over 260,000 barrels of oil one day back in 1916?

That period marked the glory days of historical Mexican oil production.

By 1921, production had peaked at 529,000 barrels a day, accounting for 25% of the world’s oil supply.

Much of that production came from the Golden Lane Trend in the Tampico-Misantla basin.

It’s called the Golden Lane for a reason — it has the highest recorded oil flow rates in the world and produced 1.4 billion barrels of oil in the early part of the 20th century.

As a result of all that production, Mexico became the world’s second largest oil producer in the 1920s, which was made possible by foreign oil companies like Shell, Jersey Standard, and Standard Oil of California.

But, as you can see from the above chart, production dropped off sharply in the late 1920s.

The years leading up to that drop-off provoked bitter labor strife and resentment on the part of Mexican oil workers against all those foreign oil companies.

In 1938, President Lázaro Cárdenas responded to all that strife and resentment by nationalizing the country’s oil industry.

He also created a state-run oil company, Pemex, to run it.

Since then, the oil and gas reserves of Mexico have been off limits to outsiders and the exclusive domain of Pemex, which got most of its oil from simple vertical drilling.

All that easy oil made Pemex complacent and inefficient.

As the years went by, it got loaded down with massive bureaucracy and too many workers.

But the company’s biggest mistake was not investing in new hydraulic fracturing and horizontal drilling technologies.

The government also played a key role in the ineffectiveness of Pemex.

Instead of using Pemex revenues to invest in new exploration and technology, they diverted money to subsidize gasoline and fund social programs, leaving the company with only 15% to reinvest.

As a result of the massive bureaucracy, bloated workforce, and parasitical government, Pemex oil production has fallen 20% since 2004 to just 2.6 million barrels a day.

That’s put a huge burden on the government, as it relies on Pemex for a third of its tax income.

This loss of tax income was a key inspiration behind President Enrique Peña Nieto’s 2014 move to allow private companies to bid on blocks of mineral rights that Pemex had been hoarding.

He saw that the only way to change Mexico’s oil fortunes was to allow foreign oil companies — like the junior energy company I’ve been telling you about — to produce oil in Mexico.

Tampico-Misantla Oil Riches Are Just

Waiting to Be Tapped

Credible sources like IHS Markit say there’s at least another 5 billion barrels of recoverable oil in Tampico-Misantla, and maybe much more.

That’s about $550 billion worth at today’s prices.

The problem is you can’t get to most of that oil through conventional vertical drilling, like Pemex was trying to do.

The only way to access these kinds of deposits is to use horizontal multistage frac wells... the kind that freed up all that Bakken oil.

Extracting oil through frac wells is something this little micro-cap oil producer excels in.

In fact, it was an early adopter of the technique and has drilled over 100 frac wells in Alberta.

Over the years, it’s become ever more efficient and cost effective.

For example, since 2011 this company has cut the operational costs of producing a barrel of oil in Canada from $22.35 to $13.68.

And get this...

In Mexico, production costs are about $9.60 a barrel, among the cheapest in the world.

That means there’s even more money to be made for the company in Mexico.

In fact, it will make money even if oil falls to $25 a barrel... or heck, even at $15!

While I doubt oil will drop anywhere near that low, it’s nice to know that you can profit on an oil company in the face of low prices and a supply glut.

And with all the political tension in the world — especially in the Middle East — I expect oil to go much higher in the coming months.

Either way, early investors who hop on this junior oil company from Canada right now can enjoy the financial ride of their lives.

We’re in the Early Stages of the Biggest

Oil Opportunity in the World

This is the first chapter of an oil and gas opportunity that may be even bigger than the U.S. shale boom.

And as you know, that was pretty big. So far, over a billion barrels of oil have been recovered in the Bakken alone.

Junior energy companies that got in early on the Bakken oil game made their shareholders very happy.

Like Brigham Exploration, which went from $17.50 to $37.50 in just six months...

And Continental Resources, which rocketed from $9 to $81...

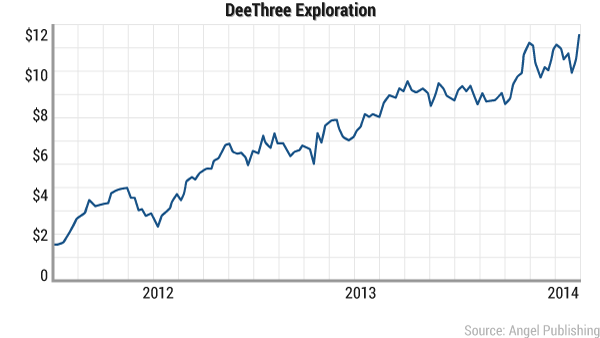

How about DeeThree Exploration, which blasted from $2 to $12...

And Oasis Petroleum, an easy triple from $15 to $51...

And Northern Oil and Gas, a $2.50 to $32 moon-shot...

I could go on with many more examples of junior oil companies that hit big in the Bakken, but I’m sure you get the point.

And here’s something else to consider...

Mexico Has the Sixth-Largest Shale Fields in the World

That reality forced the U.S. Energy Information Administration (EIA) to revise its 2040 forecast for Mexican oil and gas production upwards by a whopping 75%.

Pemex estimates that yet-to-be-discovered oil and gas reserves in Mexico could total as much as 115 billion barrels of oil equivalent, roughly three times as much as current proven, probable, and possible reserves.

Alfredo E. Guzman, president of the Altamira Petroleum Company, puts that figure much higher, at 191.88 billion barrels.

Pemex officials believe all those shale deposits have the potential to generate more oil than the country has produced since it first struck oil in the early 20th century.

That’s approximately 45 billion barrels.

Make no mistake — all that shale oil in Mexico is about to change the country’s energy fortunes forever... and make a handful of select investors very rich in the process.

But not everybody’s happy about that...

Mexicans Protest Opening the Country’s

Oil Fields to Foreigners

When Mexico opened up its oil fields to foreign energy companies, it marked the first time in 79 years Pemex didn’t have a monopoly on the oil industry.

Everyday Mexicans didn’t take this move well. In fact, there were riots throughout the country, as the opening of Mexico’s oil industry came with the end of gasoline subsidies.

The result was a 20% rise in gas prices, which hit working-class Mexicans hard.

President Nieto knew ending gas subsidies would make him unpopular.

But he also knew the only way to cash in on his country’s massive oil deposits was to enlist foreign partners with expertise in enhanced oil recovery techniques.

Of course, no foreign oil company would want to operate in a country that artificially sets energy prices below market value.

So Nieto had no choice but to end gas subsidies, take away the Pemex monopoly, and auction off Pemex-controlled oil blocks.

Make no mistake — it’s not every day that a massive country de-nationalizes its entire energy sector and opens its oil and gas riches to foreign companies.

When that happens, the profit opportunities are staggering for junior energy companies like the one I’ve been telling you about...

Not to mention for bold investors who snap up shares while they’re still cheap.

How This Tiny Oil Company Won a Piece

Of Mexican Oil Riches

On December 15, 2015, the first auction of Mexico’s onshore oil fields was held, involving 24 blocks.

One of them ended up going to this micro-cap oil company.

The timing for this company’s bid was perfect, as crude oil in mid-December 2015 was about $35 a barrel and cratering fast.

That scared off many potential competitors, giving the company the opening it needed to win its bid for essentially pennies on the dollar.

This winning bid made it the first junior oil company to gain access to Mexico’s massive oil wealth.

The block it won is a mature oil field comprising 7.2 square kilometers in the Golden Lane trend of the Tampico-Misantla basin.

As I mentioned earlier, that trend produced 1.4 billion barrels of oil in the early 20th century.

But now it’s essentially dormant.

Pemex tried to restore the trend to its former glory between 1956 and 1972, when it drilled seven wells.

But it was only able to extract a few hundred barrels a day through archaic vertical wells and simple pumping.

So in 1972, Pemex abandoned the project in search of easier pickings.

Since then, the area has been reevaluated through 3D seismic surveys. And what was found is evidence that frac wells and enhanced oil recovery techniques could exponentially exceed historical peak production.

As I said, the company that won that 7.2-kilometer oil block has proven expertise in fracking technology, with over 100 frac wells under its belt.

And costs to produce oil in Mexico are about $9.60 a barrel, among the cheapest oil production costs in the world.

So we’re looking at a company that has established a first foothold in an oilfield that not only holds vast untapped wealth, but can be produced at a cost that will turn a profit even if oil prices fall dramatically — and will make massive amounts of money when the price of oil moves higher, as it inevitably will.

That, of course, sets investors up for long-term financial gains.

And that’s just the beginning for early investors...

More Mexican Oil Auctions Are Coming

The auctioning of those 24 oil blocks I told you about was simply round one — a taste of what’s to come.

Altogether, the Mexican government is planning to auction up to 2 million square kilometers of oil basins through 2019.

In addition to these historic opportunities, Pemex is scheduled to farm out some of its existing oil fields on October 4th of this year.

The reason? It needs the technological expertise of foreign oil firms like our little $0.32 company in order to maximize production.

Make no mistake — companies that succeeded in winning bids in round one will have a decisive “first-mover” advantage when these larger blocks and farmouts are auctioned in October.

Altogether, 170 of Mexico’s 600+ onshore oil fields have been earmarked for upcoming auctions and farmouts.

Since it won the Tampico-Misantla block in the first round, this junior energy company I’ve been telling you about is in prime position to win more oil blocks — and grow rapidly as a result.

Now, you should know that the company didn’t win that bid in round one without help.

Its management knew they would need a local partner in order to succeed, so they joined forces with a major Mexican energy company that has invaluable business and governmental connections.

It also has an established distribution network, facilities, ports, trucks, infrastructure, and an understanding of the unions, communities, and local issues.

So with this oil play, all your bases are covered — technological know-how, governmental connections, distribution networks... it’s all there.

No Deal Like This Happens Without Great Management

And that’s something this little company has in spades.

Its COO has over 25 years of oil and gas experience with an impressive resume of successes.

He grew Arcan Resources into a 4,000-barrel-per-day producer from scratch (Arcan was later sold for $300 million).

He also helped transform Pacalta Resources from a 100 barrel-per-day producer to a 45,000 barrel-per-day behemoth (it was later sold for $1 billion).

This tiny oil company also has a former Pemex CFO and director on board. His presence is critical, as he has vast connections within the Mexican government, local communities, and the oil transport industry.

Even more important, this micro-cap has a visionary president who is committed to growing the company into a mid-tier producer.

So when he learned Mexico was going to open up the country to foreign oil companies, he flew down to investigate the opportunities.

He was stunned by what he saw.

He saw it had good infrastructure in place, including existing wells that could be brought back to life with enhanced recovery methods.

He saw they were near port facilities, making transport easy.

And, most importantly, he saw that 2D and 3D seismic surveys done by Pemex indicated that many of these fields had a high probability of holding large oil deposits.

This was especially true of a particular block in the Tampico-Misantla basin.

It was clear to the president that this oil field — like so many others in Mexico — was underdeveloped and under-explored.

Armed with this knowledge, he developed the partnership strategy I told you about that won his company that Tampico-Misantla block.

Now He’s Aiming to Grab More Oil Blocks in Future Auctions

Winning that block was just the beginning, and he’s promised his shareholders he will leverage his company’s first-mover status to “aggressively” go after more oil blocks and Pemex farmouts.

In particular, he’s set his sights on blocks in an area known as Chicontepec, which has an estimated 59 billion barrels of oil equivalent.

That’s an estimated $2.95 trillion worth of oil.

Can you see the potential for this company here?

The smart money sure does.

That’s why when the company announced in January it was offering over 8 million private placement shares at $0.28 apiece, high net worth investors snapped them all up in just one month.

As a result, the company raised enough money — $5.095 million (Canadian) — to meet 2017 work commitments at its Tampico-Misantla block.

Now those investors are in prime position to make obscene profits from this company.

They know gaining future oil blocks in upcoming auctions and farmouts will skyrocket its share price.

How much? Well, when it won the Golden Lane block from the first auction, its price shot up 171%.

You can bet it’ll go up MUCH more next time.

The next opportunity for this company to gain control over prime Mexican oil blocks will be October 4th, when Pemex is scheduled to announce the winning bid for its onshore oil farmout.

That’s why you need to get in now.

Because if you’re not in before Pemex announces its award, your rare opportunity for financial independence will be gone.

Do You Have the Cojones for a Play Like This?

Perhaps you recoil at the notion of investing in a country that allows millions of its people to sneak into the U.S. every year and take jobs from hardworking Americans.

Maybe the idea of putting your money to work in a country rife with corruption and drug gangs that have infiltrated our country is just too much to bear.

Or maybe you just don’t like the idea of helping a country that subsidizes industries that are putting American companies out of business.

If that’s the case, I understand. It’s good to have morals.

But please know trades that can make you financially independent don’t come around every day.

And consider this: There’s nothing you can do about illegal immigrants from Mexico... the country’s corruption... or the fact that Mexico’s cheap labor hurts American businesses.

So why not profit on the whole mess?

The bottom line is this little oil company from Canada represents a once-in-a-generation opportunity to achieve a legacy of wealth you can pass down for generations.

It’s up to you whether you want to take it or not.

I Want to Give You a Report on This Company for FREE

If you’re still here, then you’ve shown you want to grab this extraordinary profit opportunity.

That’s good.

But know this: There isn’t a moment to lose.

The stock’s already gone up 171% since it won the rights to the Tampico-Misantla oil block.

As soon as mainstream investors realize what this company’s up to, as early birds snap up shares, the ridiculously cheap price you can now get this stock at will be gone.

That’s why I’d like to send you my FREE report on this company. You can have it in your inbox, at no charge, just a few minutes from now.

All I ask in return is that you take a trial subscription to my Crisis and Opportunity newsletter.

Crisis and Opportunity is my research and advisory service. It’s where I disclose all the details on the hottest investment opportunities in the world that few people would ever dare to dig up.

In exchange for your test drive, I’d like to send you my FREE report, “Better Than the Bakken: The Mexican Oil Play That Can Change Your Life.”

If you agree, you’ll have access to far more than this report.

You’ll also get:

- Exclusive rights to my members-only “e-alerts,” which include breaking news on emerging profit “crisis zone” opportunities.

- Password-protected access to the Crisis and Opportunity website, which contains an archive of all my commentary, picks, and current and past portfolios.

- A complimentary subscription to Energy and Capital, where some of the most highly touted experts in energy will keep you abreast of developments in the energy industry so you can trade the sector with confidence.

- A complimentary subscription to Wealth Daily, where some of the best investment minds on the planet will bring you market insight and commentary to help you make sense of today’s crazy investing environment.

- Access to VIP Service — A subscription to Crisis and Opportunity qualifies you for VIP service. You can contact the VIP team with any questions at (844) 310-4115.

And, of course, you’ll get the free and immediate opportunity to profit on the “Mexican Bakken” oil play I’ve written about in the special report I’d like to send you.

In a second, I’ll show you how simple it is to sign up for Crisis and Opportunity and get this FREE report.

But first I want you to know...

There’s Another Situation That Stands To

Make You Profits of Equal Measure

Like the play I’d like to send you the FREE report on, the next opportunity I’m about to reveal is an oil investment in Mexico.

Most people aren’t familiar with the company I’ll reveal.

But they soon will be.

Like that $0.32 company I’ve been telling you about, this firm won an oil block in the first round of Mexican auctions.

It’s in the coveted Chicontepec region, which holds an estimated 59 billion barrels of oil.

According to the company, the block it won in the first round of auctions holds 4.2 billion barrels of crude oil.

And like so many Mexican oil fields, it’s grossly underdeveloped.

And get this: Right now the company is selling for $0.25 a share.

The smart money didn’t miss a beat with this company, either. They snapped up $11.2 million (Canadian) in private shares in just a little over a month.

I’ve never seen such a clear-cut profit opportunity in my life... and I may never see another one like this again.

You can learn all about it in a second report I want to give you for FREE: “How to Make Life-Changing Gains From the Mexican Shale Revolution.”

That’s two reports for free, just for agreeing to take a trial subscription to Crisis and Opportunity.

But Be Forewarned: Both of These Stocks

Are Very Thinly Traded

It wouldn’t take much additional volume to jack the price of these stocks up very quickly.

That’s why I’m only willing to release 500 of these special reports.

I don’t want to flood the market with buyers and drive the price of these stocks up too fast.

That just wouldn’t be fair to my subscribers.

Both of These Stocks Stand to Skyrocket Thanks

To Mexico’s Exploding Demand for Oil

Despite its massive oil deposits, Mexico still has to import oil from the U.S. to meet domestic demand.

And according to Reuters, that demand could soon top a million barrels a day (in September 2016, Mexico imported 960,000 barrels a day — a record).

There are two reasons Mexico needs these imports: Its economy is growing, and the country has been unable to increase its refining output to satisfy growing energy demand.

On the demand side of the equation, the country’s GDP in 2015 was 2.3%. That’s up from 2.1% in 2014 and 1.4% in 2013.

In fact, the economy has expanded for the last 27 consecutive quarters.

Today Mexico is the world’s fourth-largest consumer of gasoline thanks to booming car sales, which increased 18% per year as of September 2016.

On the supply side of the equation, refineries in Mexico are running at about 60% of their 1.576 million barrel-per-day capacity.

The reason? Mexico slashed $5.36 billion from the budget of Pemex.

That leaves the onus on Pemex to import more oil to cover demand.

And that’s a big reason the country is partnering with foreign oil companies. Mexico knows it will need to import more and more oil unless it starts taking advantage of its massive unconventional oil deposits.

To do that, it knows it needs foreign help.

To say that makes me excited about the two junior oil companies I’ve told you about would be the understatement of the year.

You can learn about them both just by agreeing to take a Crisis and Opportunity trial subscription.

I Make My Subscribers a Lot of Money

In Crisis and Opportunity

I’m not talking little 2% wins, either.

Take a look at these gains to see what I mean...

Sharyn Gol JSC, 236% in 111 days...

Unilife, 251% in 30 days...

Harris and Harris Group, 116% in five weeks...

China Yuchai International, 268% in seven months...

Bluefly, Inc., 102% in two months...

Sirius Holdings, 129% in six weeks...

Plug Power, 502.94% in just six weeks...

Silver Standard Resources, 108.2% in eight months...

Just Energy Group, 110.21% in 14 months...

Hi-Crush Partners, 155% in 12 months...

New Zealand Energy, 150% in 16 months...

As you can see, I can deliver some huge gains.

But don’t just take my word for it...

“An absolute winner for me. In 2 days the price shot up like the sky is the limit. Thanks for the suggestion. Subscription price is paid back, thanks.”

— F. Lambert

“Wow! That is the quickest home run I ever experienced. In at $9.92, trailing stop got me out at $26.02. Simply amazing! Only wish I had bought more.”

— W.D.

“Made a total profit of $97,500. That was the biggest profit I have ever made. Thank you very much for the great work you have done. Keep it up!”

— N.N.

This Mexican oil opportunity stands to be hundreds of times better than anything I’ve ever reported on...

I’m dead serious. Your chance to retire on the spot is staring you in the face. All you have to do is seize the opportunity and run with it.

It’s like something out of a storybook. If I were dreaming up a perfect environment for banking the biggest profits most of us have ever seen...

The current opportunity in Mexico is darn close to what that dream would look like.

And since you’re still with me, you must agree.

You’ll also agree that I could easily charge a fortune for information like this.

How many independent research outfits out there have the connections and clout to arrange short-notice, one-on-one meetings with banking, government, and business insiders in the most lucrative emerging markets in the world?

I challenge you to name one.

What do you think a big-name hedge fund manager would charge for a private consultation revealing what stands to be one of the most lucrative investment opportunities of our time?

$50,000? $100,000?

Believe Me, I Know How Much I Could

Charge for This Information

But I’m not going to charge a fortune just so 10 people can have access to information that stands to change their lives.

I want everyone to have a fair shot.

So my price to you is only $1,599.

That’s right. For less than two grand, you get a full year’s worth of Crisis and Opportunity, plus all the additional profit resources I mentioned earlier.

This is just a trial subscription for you.

It’s 100% risk and obligation free.

There’s no gimmick here, and no fine print, either.

For the Sake of Your Own Future, You Must Sign Up

Yes, I want you to sign up even if you fully intend to collect the refund — so you can put some cash into these little-known oil companies that are about to make a big splash in Mexico... before everyone else does.

THEN you can decide whether or not to stay on for the long haul.

You're not paying a cent for information that could fund your retirement.

All you’re doing is putting $1,599 on the table and letting me hold it in escrow for a month while you decide if Crisis and Opportunity is worth what I’m asking for it.

But I’m positive once you see the kinds of gains I can deliver, you’ll be a Crisis and Opportunity subscriber for life.

That’s because there’s always the chance to make huge gains somewhere in the world on crisis, strife, and political transformations.

Bottom line: For just under a thousand bucks, you get the best emerging market investment analysis and guidance you’ll ever receive.

Warning: There’s No Telling How Long

The Price Will Stay This Low

Like I said, this is simply an introductory price.

But if you sign up now, I promise you’ll never pay more than the introductory price: $1,599 a year.

That’s the best lowball deal I can make you.

So now it’s decision time. I’ve done everything I can do to make this a no-brainer for you.

I’ve shown you how two tiny energy companies can create a legacy of wealth for you.

I’ve offered you 30 full days of risk-free access to all of Crisis and Opportunity’s services and benefits... including the TWO special reports I’m going to send you at no charge.

And I’ve cut the price to the bone so you can take a trial subscription to Crisis and Opportunity right now.

So now it’s up to you.

If you believe it’s worth letting me hold your $1,599 while you get inside information that could change your life, then click the order button above... before rank-and-file investors catch wind of this opportunity and take it from you.

To your wealth,

Christian DeHaemer

Investment Director, Crisis and Opportunity

P.S. If you’re not on board these micro-cap energy companies before the Mexican government announces its oil block awards on October 4th... if you’re not one of the first 500 people to get my reports on these companies... you will have missed your best chance at life-changing wealth.

Please don’t let that happen.